A Landmark Victory:

Trigger Lead Ban Signed Into Law

President signs the Homebuyers Privacy Protection Act, officially banning abusive trigger leads after a coordinated broker and industry push.

Trigger Lead Ban Explained

-

Trigger leads were more than a nuisance for homebuyers and brokers—they were a consumer data privacy violation.

When a homebuyer had their credit pulled, it triggered a chain reaction.

The credit bureaus sold personal consumer data (full name, contact information, credit score range, and more) to other lenders and telemarketers without consent.

The result: borrowers were flooded with unsolicited—and often deceptive—calls, texts, and emails.

-

Stops the sale of personal consumer data at the source: the credit bureaus.

Ends abusive practices while preserving narrow exceptions and allowing consumers to opt in.

Protects homebuyers from a flood of spam calls, texts, and emails.

Restores trust in the mortgage process.

-

Current Servicer: Allows the borrower’s existing servicer to continue monitoring their asset.

Current Originator: Allows the company that originated the mortgage (brokerage or lender) to maintain contact with the borrower.

Current Banking Relationship: Allows financial institutions where the borrower already has accounts to communicate as established relationships.

-

Implementation details are still being finalized, but the law will take effect 180 days after signing—by March 2026.

-

Our supporters told us this was their top priority—and we made it happen. We now need your support. Every dollar counts, and even $5 a month helps fuel this fight.

Join the BAC Facebook Group, attend our next monthly Advocacy for All Call, and be part of what’s next.

Advocacy works—and with your support, the momentum continues.

Thank You to Our Partners

Your Support Makes This Work Possible

Thank You to the Trigger Lead Coalition

These organizations, among others, stood with us to help end abusive trigger leads.

We’re Just Getting Started

Help Us Keep Winning for Brokers & Consumers

“If you want more of this kind of progress, brokers need to keep showing up—and start funding the fight.

We’ve proven that when brokers get behind an issue, real change is possible. Now it’s time to keep that momentum going—and take on what’s next.”

Brendan McKay, BAC Chief Advocacy Officer & Co-Founder

Delivering on Our First Promise

When we launched the BAC, we asked our earliest supporters to help set the agenda. The response was overwhelmingly clear: ending abusive trigger leads was our top priority. This victory shows what’s possible when brokers get involved, stay organized, and invest in advocacy.

✉️ 25,000+

Letters sent to Congress

🏛️ 250+

Meetings with Congress

👥 150+

Bill cosponsors secured

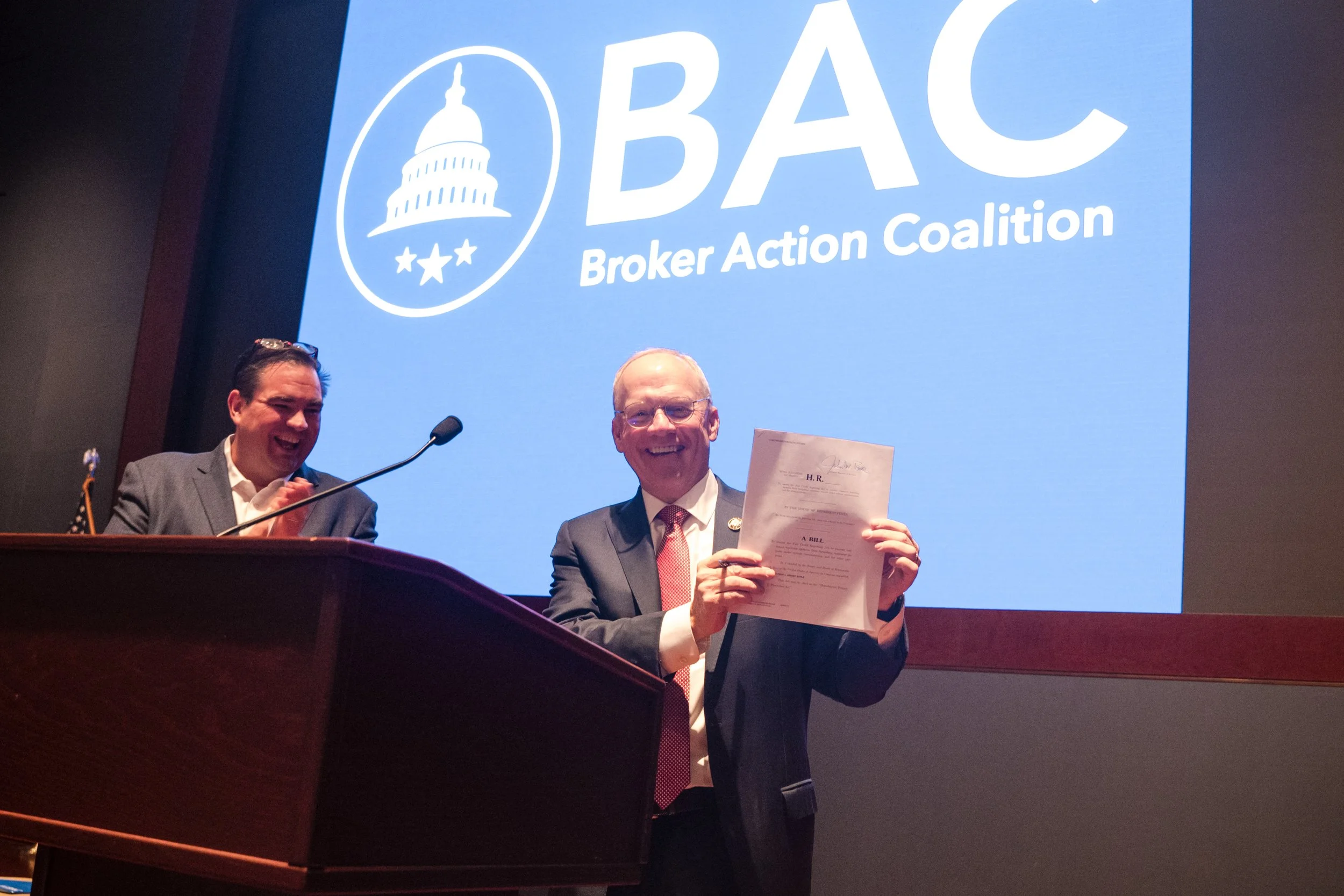

Our two Advocacy in Action fly-ins brought hundreds of brokers to Capitol Hill to make trigger leads impossible to ignore. In fact, at our 2025 event, lead sponsor Rep. John Rose reintroduced the bill and signed it live before our members — turning advocacy into action in real time.

Trigger Lead Press Releases

Recent Media Coverage

What’s Next?

The fight for brokers and homebuyers doesn’t stop here. Stay involved and help us drive the next big win.